Bitcoin’s Compute Power Poised to Slow—Finally

Mining hardware preorders drop, imports decline, and AI shakes things up

Bitcoin’s mining difficulty saw a moderate decline of 2.12% last week, breaking a streak of eight consecutive upward adjustments. This marks the first drop in nearly four months, providing miners some long-awaited relief.

According to Luxor’s Hashrate Index, recent cold weather across the U.S. contributed to the decline as mining companies curtailed operations. However, mining companies are gradually resuming capacity, with Bitcoin’s three-day average hashrate rebounding above 800 EH/s since the last difficulty adjustment.

Yet other factors suggest the rapid growth in mining competition may be slowing. A return to the sharp difficulty surges seen in late 2024 seems less likely in the near term.

Preorders Suggest Slower Growth in Competition

Archive data from TheMinerMag shows that institutional mining firms ramped up mining hardware purchases in Q3 and Q4 2023. These deployments, which typically take six months to a year to fully energize, contributed to Bitcoin’s post-halving hashrate surge—particularly the net increase of approximately 140 EH/s in Q4 2024 alone.

For context, Bitcoin’s price rose by about 50% from September 2024 to January 2025, while Bitcoin’s average hashprice increased by only 30%. The network’s 20% increase in hashrate absorbed much of Bitcoin’s price momentum, limiting the revenue gains for mining companies.

However, as hardware purchasing activity cooled down in the second half of 2024, mining competition is expected to cool in the coming months. Data from TheMinerMag on U.S. imports of mining hardware supports this trend, showing a decline in exports of leading machines—including WhatsMiner, Avalon, and Antminer—to the U.S. in Q3 and Q4 2024.

Feel free to reach out for API access to TheMinerMag’s database of historical preorders and shipment records.

The DeepSeek AI Shockwave

At the same time, more mining firms are pivoting toward a dual Bitcoin+AI model to diversify revenue streams.

Riot Platforms, for example, recently paused a 600-megawatt Bitcoin mining expansion in Texas, reserving that capacity for potential AI/high-performance computing (HPC) hosting. While no commercialization details have been disclosed, this shift represents at least 30 EH/s of Bitcoin hashrate that will not come online.

Similarly, Bitfarms announced it has signed a binding letter of intent with HIVE to sell its unfinished 200 MW Bitcoin mine in Paraguay for $85 million in cash. Bitfarms plans to reinvest the proceeds into its 1-gigawatt U.S. expansion, which includes Bitcoin and AI/HPC infrastructure.

Adding another layer of complexity, last week’s breakthrough by China’s DeepSeek AI sent shockwaves through the technology sector.

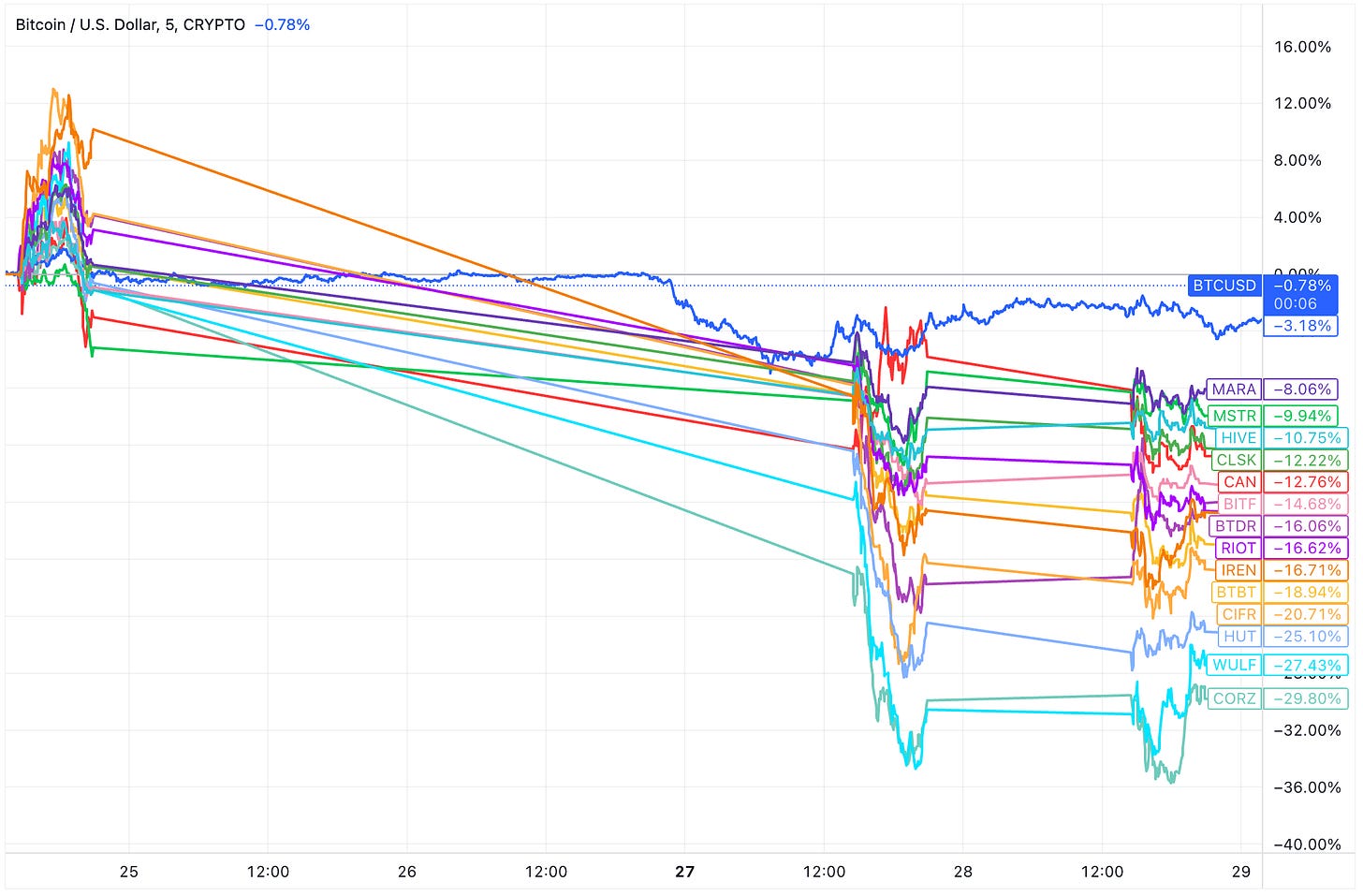

DeepSeek’s success—achieved with relatively limited resources—sparked concerns that Silicon Valley’s AI investments may be overhyped. This triggered a trillion-dollar market selloff in tech stocks, particularly among AI-focused companies.

The ripple effect extended to Bitcoin mining companies, particularly those investing in AI hosting infrastructure or signaling a pivot toward AI. However, Bitcoin itself recovered swiftly after a 5% drop on Monday, a move that some analysts say suggests Bitcoin is decoupling from its historical Nasdaq correlation.

Regulation News

Stolen ID Spark $1.9M Bitcoin Mining Power Theft in Malaysia - TheMinerMag

Hardware and Infrastructure News

Northern Data Recovers Bitcoin Hashrate Amid Ongoing Sale of Peak Mining - TheMinerMag

Bitcoin Mining Difficulty Eases for First Time in Four Months - TheMinerMag

Argo Relocates 5,293 Bitcoin Miners to Merkle's Tennessee Site - TheMinerMag

HIVE Acquires Bitfarms' Paraguay Bitcoin Mine for $56M - TheMinerMag

Bitcoin Miners Consume 20% of Power, Says Kentucky Utility - TheMinerMag

First-Ever Bitcoin Hashrate Fundraiser Mines Full Block for Non-Profit - TheMinerMag

Corporate News

DCG Spins Off Proprietary Bitcoin Mining from Foundry, Forming Fortitude Mining - TheMinerMag

Grayscale Launches ETF Tracking Bitcoin Mining Companies - TheMinerMag

Financial News

Bitcoin Miners Slump as Nasdaq Slides on DeepSeek AI Fears - TheMinerMag

D.E. Shaw takes stake in bitcoin miner Riot Platforms, sources say - Reuters

Core Scientific Top AI Pick in Bitcoin Miners Despite DeepSeek Dislocation: Bernstein - CoinDesk

Feature

Crusoe / Upstream Data Patent Ruling, Lancium’s Stargate Deal, and 2024 Year-in-Review - The Mining Pod

Zhan Ketuan: Chinese crypto and AI mogul becomes US target - FT

Bitcoin Mining in South America with Erick Vera - The Mining Pod