Miner Debt Sparks Consolidation – And Bankruptcy!

The Bitcoin Halving's painful hangover is still on

Over the past few weeks, we have seen the news of Griid and Stronghold being acquired, Core Scientific restructuring convertible notes, and, most recently, the Chapter 11 filing by Rhodium Enterprises.

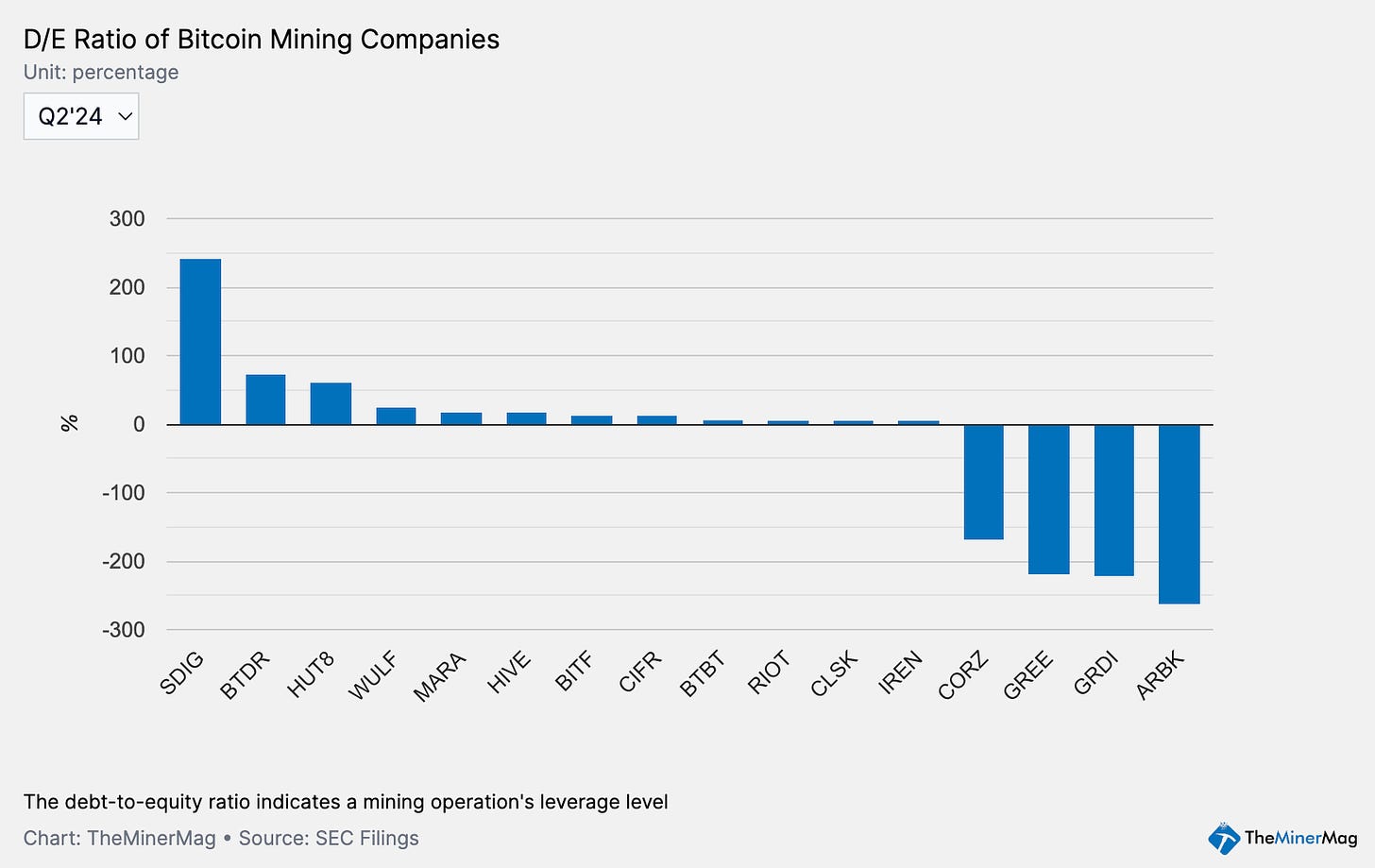

Perhaps not surprisingly, what these companies have in common is their high debt-to-equity ratios – and the fact that they still possess mining infrastructure assets. However, bitcoin’s current low hashprice isn’t helpful at all for highly leveraged mining operations to sustain their cash flows, let alone investing in fleet upgrades. The debt, coupled with bitcoin’s halving hangover, is forcing these companies to either significantly deleverage their positions or seek a new lifeline.

As shown in the graph above compiled by TheMinerMag (with an option to toggle the quarters on the live dashboard), Griid had more debt than assets as of June 30, resulting in negative shareholder equity. As part of CleanSpark’s transaction to acquire Griid, it also signed a $55 million credit agreement allowing Griid to pay off several existing loans.

Meanwhile, Stronghold still had a D/E ratio of 241% as of June 30 after a series of deleveraging efforts made since the 2022 bear market. Additionally, it reportedly resumed a monthly debt amortization of $1.6 million beginning in July before Bitfarms announced the acquisition, which included $50 million in assumed debt.

Rhodium Enterprises, once a promising operation set to get publicly listed in the U.S., filed for bankruptcy protection over the weekend after reportedly defaulting on a loan of over $50 million. That wasn’t too surprising either, because Rhodium’s D/E ratio was as much as 839.56% as of Dec. 31, 2022 – the last available data of its balance sheet.

Core Scientific, on the other hand, also had a shareholder equity deficit as of Q2. However, its expansion plan for AI hosting, initiated in June, has worked out well enough to fuel its stock prices, triggering a compulsory conversion of convertible notes in early July. That eliminated over $260 million in debt since Q3. Additionally, Core raised $400 million in a new convertible notes issuance, using the proceeds to pay off another $267 million in existing debts in a bid to slash the interest rate from 12.5% to 3%.

Regulation News

National Power Administration of Paraguay Seizes 693 Miners in Illegal Bitcoin Mining Operation - Bitcoin.com

Thai authorities raid illegal bitcoin mine after power outages - AFP

Hardware and Infrastructure News

Bitcoin Fees Spike Amid Babylon Staking Mainnet Launch - TheMinerMag

Mawson Resumes Ohio Lease Following Termination Notice - TheMinerMag

Cipher Mining to Acquire New 300 MW Site in Texas - TheMinerMag

Iris Energy Expands 10.5 EH/s Bitcoin Hashrate with S21XP - TheMinerMag

Corporate News

Bitfarms Acquisition of Bitcoin Miner Stronghold a ‘Strategic’ Move Against Rival Riot: Experts - Decrypt

Rhodium Files Chapter 11 for Bitcoin Mining Subsidiaries - TheMinerMag

Core Scientific gets approval to bring high-powered computing for AI to Denton - KERA News

Financial News

Bitcoin Mining Opportunity Is Worth About $74B, JPMorgan Says - CoinDesk

Bitcoin Mining Is So Rough a Miner Adopted Michael Saylor's Successful BTC Strategy - Coindesk

Feature

Trump’s ‘Made in USA’ Bitcoin Threatens China Juggernaut Bitmain’s Reign - Bloomberg

Institutional Bitcoin Miner Investors Mostly Care About AI Data Center Potential—Not BTC, Says Bernstein - Decrypt

Is Bitcoin Dirty? Reviewing The Bitcoin Mining’s Documentary With Alana Mediavilla - The Mining Pod