In a new filing this week as part of its ongoing SPAC deal in the U.S., BitDeer disclosed more recent financial information about its operations.

One of the main data points was the 522 megawatts (MW) of mining capacity in use across the U.S. and Norway as of Jun’22, which powered 4.2 EH/s and 6.3EH/s in proprietary mining and hosting hashrate, respectively.

Based on an earlier investor presentation, BitDeer’s operational capacity as of Sep’21 was 280 MW. A majority of its growth since then was driven by the construction in Rockdale, Texas.

BitDeer said its operational capacity in the Lone Star state reached 386 MW as of June. By the end of 2022, it had increased the developed capacity of the Texas site to 562 MW, although it didn’t specify if that was operating at full capacity.

BitDeer’s build-out in Rockdale makes it a major rival to Riot, which claims to currently have 700 MW in developed capacity also in the Texas city. Per the revenue diversification breakdown compiled by TheMinerMag below, the competition was indeed rising between the two.

The half-a-gigawatt capacity powered BitDeer’s diversified business models with three major segments: Proprietary Mining, Hashrate Sharing, and Hosting. Although BitDeer generated much less revenue from proprietary mining than Riot, it made $75 million through Hashrate Sharing, which was akin to selling cloud mining contracts utilizing its own hashrate.

With the declining prices of Bitcoin in 2022, BitDeer’s three segments played a more equal role in revenue contribution compared to previous years. In fact, the revenue from the Hosting segment increased from $26 million in FY’21 to $60 million in the first half of 2022 alone.

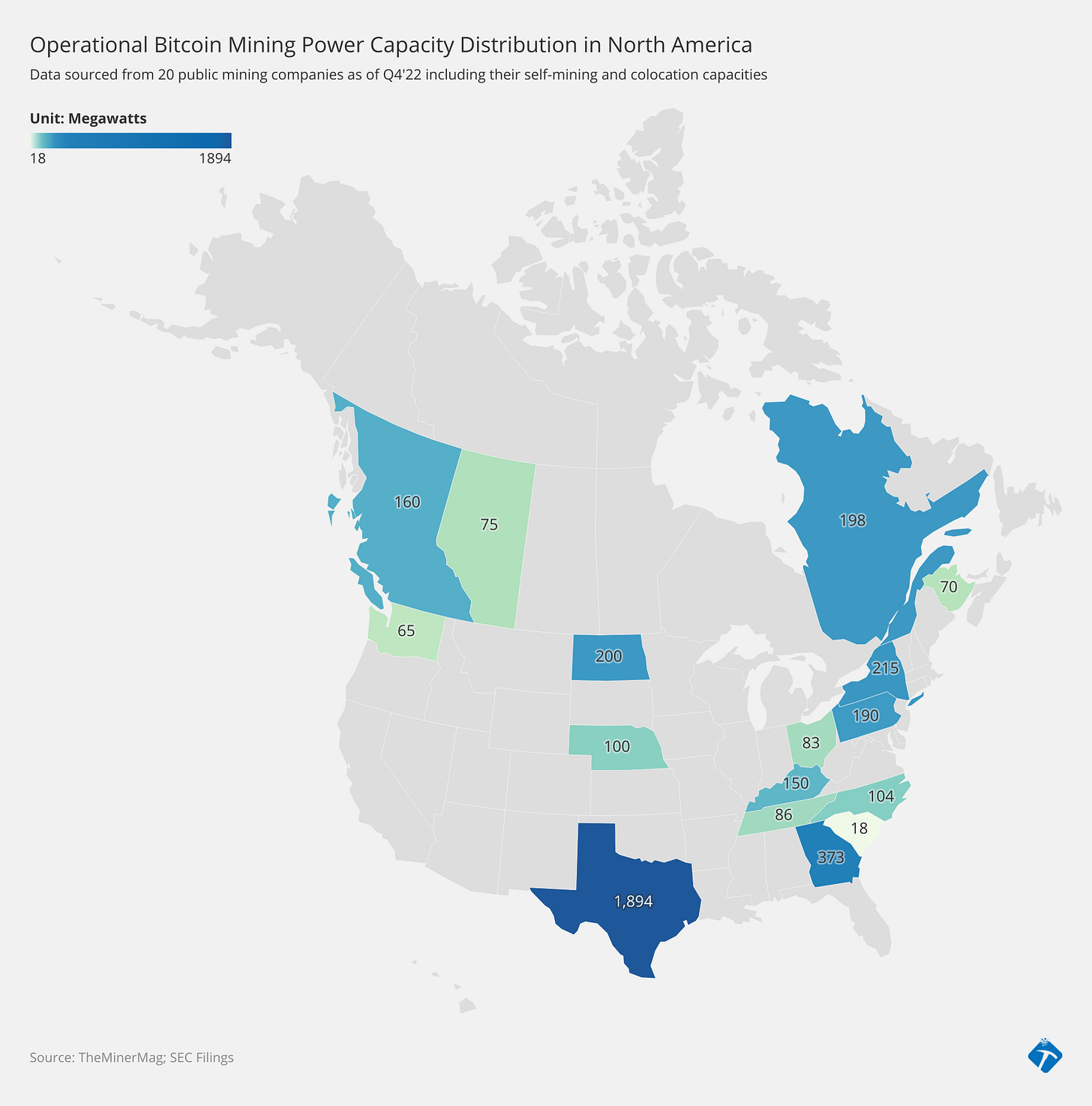

Per an updated North American mining power distribution map by TheMinerMag, Texas was the largest mining hub with about two gigawatts of operating capacity as of Q4 based on data disclosed by 20 publicly listed mining companies. As Reuters put it in a headline this week: “Despite industry headwinds, Bitcoin mining booms in Texas.”

Financial news

Bitcoin rally is ‘pure gravy’ for miners finally seeing a light at the end of the tunnel - The Block

Bitfarms Sinks to Fourth-Quarter Loss as Difficulty, Costs Rise - CoinDesk

Bitcoin Mining Industry Is Well Positioned to Participate in a New Cycle: Bernstein - CoinDesk

Bitcoin Miners' Revenue From Fees Rises Suggesting the Onset of Major Bull Run - CoinDesk

Corporate news

Immersion Cooling Firm LiquidStack Secures Series B Funding to Build Manufacturing in U.S. - CoinDesk

Bitcoin Mining Firm Navier Starts Tokenized Hashrate Marketplace for Retail Customers - CoinDesk

Core Scientific Bankruptcy Judge Approves Transfer of Over $20M of Equipment to Its Exclusive Energy Negotiator - CoinDesk

Hardware and Infrastructure

BlockFi to sell $4.7 million of physical mining assets amid bankruptcy - The Block

Bitcoin mining difficulty rises 7.6% to set new all-time high as hashrate jumps - ForkastNews

Feature

Despite industry headwinds, Bitcoin mining booms in Texas - Reuters

Why some provinces are pulling the plug on new crypto mines - CBC.ca

Are you a journalist or analyst seeking more information or comments from industry experts? We’d love to help!