Miner Weekly: Lenders own 50% of Core’s self-mining hashrate

Here’s a breakdown of who owns how much

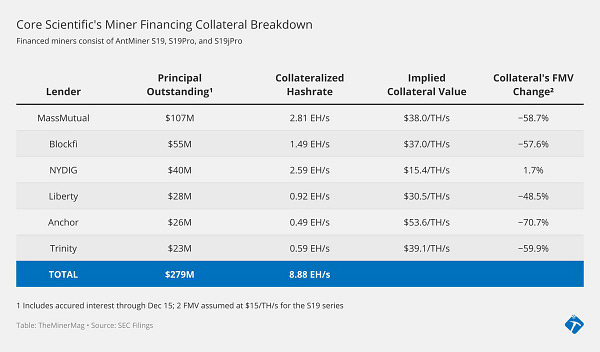

A creditor presentation deck that somewhat went unnoticed in Core Scientific’s bankruptcy news this week shows that for the first time, Core has provided a breakdown of which lender has financed how much of its self-mining fleet.

In November, Core’s realized self-mining hashrate reached 12.8 EH/s. That means the company alone mined 5% of the total bitcoin rewards up for grabs last month.

It turns out that a big portion of Core’s hashrate capacity is collateralized against equipment loans it borrowed from six lenders. See a detailed thread from TheMinerMag below.

Here’s the creditor presentation deck if you want to see how Core forecasts its cash flow in the coming months. One thing is for sure: no more hodl and “all BTCs produced [are] assumed to be sold soon after mining.” Core’s self-mining capacity currently produces 50 BTC / day on average. Happy holidays!

Regulation news

British Columbia pauses electricity connections for crypto mining, citing 'massive' consumption - The Globe and Mail

Kazakhstan Tightens Regulation for Miners, Looks to Develop Broader Crypto Industry - CoinDesk

Financial news

Bankrupt Crypto Miner Core Soars in Move Reminiscent of Hertz - Bloomberg

Core Scientific Approved for $37.5 Million Bankruptcy Loan - Reuters

Corporate news

Blockware Customer Accuses Bitcoin Mining Firm of Fraud - CoinDesk

Greenidge Deal With NYDIG Would See Miner Shift to Hosting - The Block

Inside Core Scientific’s Prearranged Bankruptcy - CoinDesk

Hardware and Infrastructure

Crypto Miners Bracing for Impact from Brutal Winter Storm - The Block

Core Scientific Eyes Sale of Up to 1 GW facilities amid bankruptcy - The Block

Europe’s Last Bitcoin Mining Refuge Is No Longer Viable - CoinDesk

Feature

Crypto winter is here. In Asia, miners and traders are shutting up shop - Rest of World

Bitcoin Mining Jumps 3.27% After Substantial Dip. What Does Luck Have to Do With It? - The Block