Core Scientific says it isn’t “hopelessly insolvent”

Citing bitcoin’s price rebound and declining energy costs

Over the past week, there has been a clash of sorts between the equity and debt holders of Core Scientific. In short, they seem to have opposing opinions on whether we have bottomed.

The ad hoc group of stockholders of Core filed a motion earlier last month to form an Equity Committee so that they are better represented in Core’s ongoing Chapter 11 case. After all, they are not at the front line for claims. The group holds economic interests of 69 million common stocks. The person with the largest number of shares in the ad hoc group is Kevin Turner, the former CEO of Core and ex-COO of Microsoft.

The group’s rationale is that Core may well be solvent now as the market conditions have improved. Core itself responded later last week and supported the idea with a budget of $4.75 million, saying:

“Courts have held that an equity committee is unwarranted when a debtor is ‘hopelessly insolvent.’...Based on market factors, the Debtors do not believe they are hopelessly insolvent.”

It charted the graph below as evidence and said its energy costs have “declined steadily” since the petition date as underlying fuel costs has generally decreased—but did not provide specifics.

However, the ad hoc group of noteholders, which included debt creditors like BlackRock and Apollo, filed an objection to the motion, arguing:

“Speculation on future bitcoin pricing is not a business plan, nor does it justify the extraordinary relief sought in the Equity Committee Motion… The Equity Group should not be permitted to gamble with the creditors’ money.”

For now, the judge overseeing the case has indicated he would allow stockholders to form an official committee in the bankruptcy with conditions. Guess we will find out.

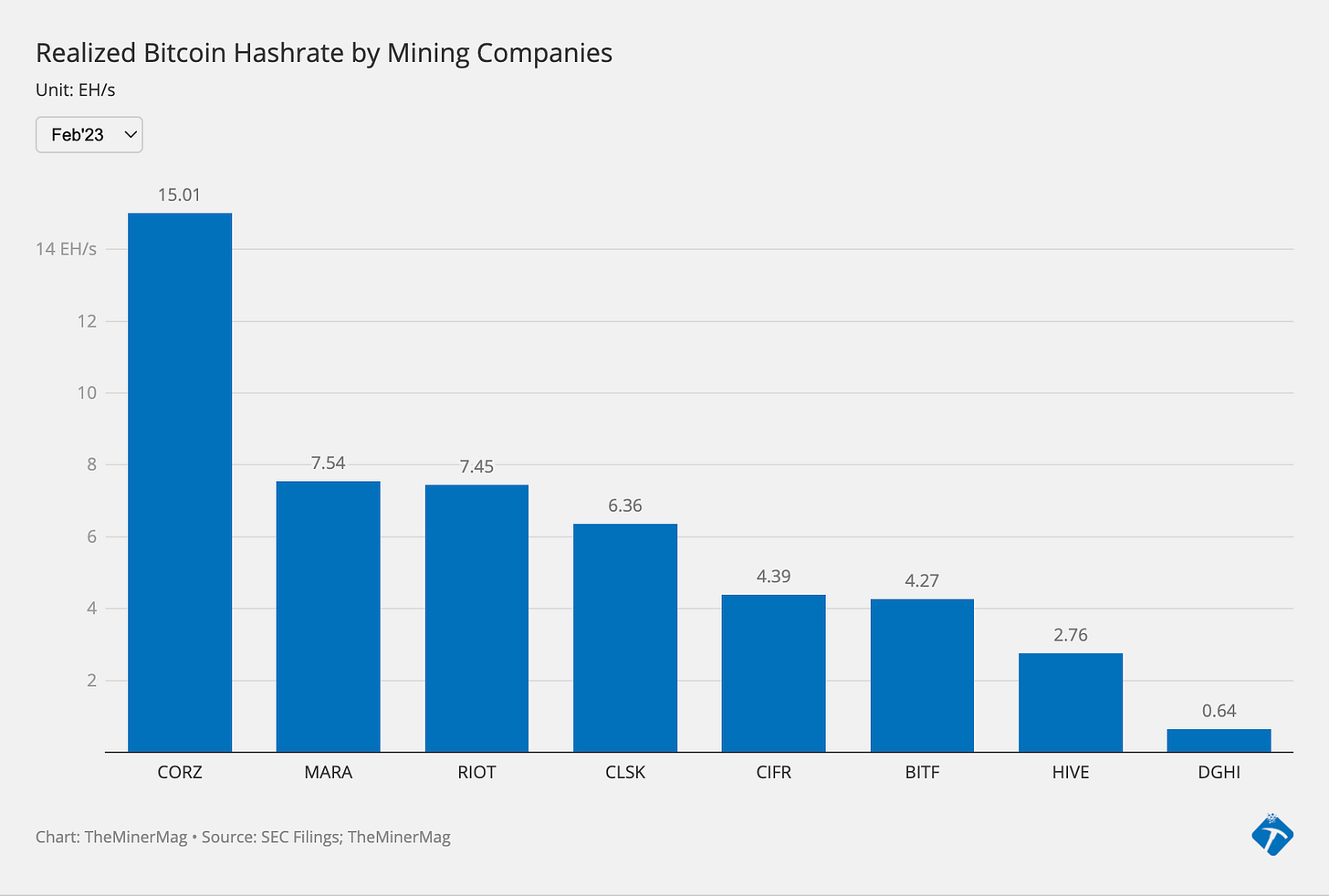

Production and Realized Hashrate Updates

Regulation News

Judge Signs Contempt Order Directing U.S. Bitcoin to Cease Operations in the Falls - Niagara Gazette

Crypto Miners Await Verdict on Exclusion from IRS Broker Reporting Rule - Bloomberg

Corporate News

Core Scientific Bankruptcy Judge Set to Approve $70M Financing Deal From B. Riley - CoinDesk

TeraWulf Announces Closing of $28 Million Underwritten Equity Offering - Link

Marathon Digital to Restate Some Results on Accounting Issues - CoinDesk

Riot Delays 10-K Filing Due to Impairment Calculation Issues - CoinDesk

Feature

Bitcoin Miner Capitulation Has Been 'Completely Different' This Cycle - Decrypt

Bitcoin Miners Are Starting to Emerge From Brutal Crypto Winter - CoinDesk

Bitcoin Rally Is Much-Needed Lifeline for Troubled Miners After Grim Quarter - Bloomberg

TeraWulf’s Nuclear Bitcoin Plant Is Just One Piece of the Green Mining Puzzle - Decrypt

Are you a journalist or analyst seeking more information or comments from industry experts? We’d love to help!