The recent bitcoin market rally is apparently bringing back the exuberance among bitcoin mining companies – and perhaps the appetite for leverage again?

Publicly traded data center operator Northern Data sent a press release early Thursday, announcing a €575 million (about $610 million) debt financing facility with stablecoin issuer Tether. The proceeds will be used to expand its hardware for generative AI and bitcoin mining.

It is interesting to note that Northern Data sent the press release twice. The initial version was relatively rough but included some details of the loan, such as the fact that “the facility is unsecured, at standard market conditions and has a term until 1 January 2030.”

The second version that was sent a few hours later included a few (fluffy) quotes from Northern and Tether but removed details about the loan facility.

It will be interesting to also see how public mining companies report their cash flow activities for Q3’23 in the coming weeks. The earnings call schedules are listed below.

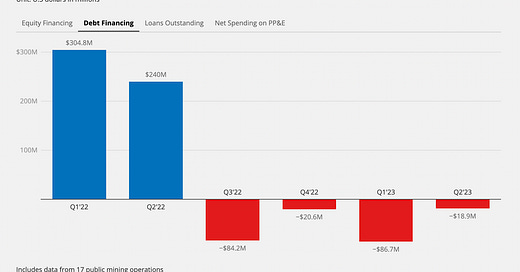

Based on data analyzed by TheMinerMag, the aggregated cash flow from debt financing activities among 17 public mining operations has been steadily negative since Q3’22, an indication of them deleveraging to get by during the bear market.

In other news that is seemingly in response to the recent market rally, Core Scientific said it has reached agreements with its equity and debt holders regarding a reorganization plan and terms sheet. With that, Core expects to emerge from Chapter 11 by the end of the calendar year.

But it remains to be seen how soon the proposed reorg plan will be approved by the court. ICYMI: Reuters reported recently that the judge who previously handled Core’s bankruptcy case as well as 3,500 other cases suddenly resigned and that is causing the court to reassign the massive workload.

Ohio-headquartered bitcoin mining firm GRIID also appears to be taking advantage of the current market temperature. It first submitted a plan to go public by merging with a SPAC (special purpose acquisition company) in November 2021 but postponed the deadline for completing the deal multiple times over the past two years.

The SPAC said earlier this week that it is finally moving the deal forward with a special meeting scheduled on November 30 for shareholders to vote on the business combination. If approved, GRIID will be the latest addition to more than 20 publicly traded mining companies in the U.S.

Earnings call season

As the earnings call season approaches, the chart below from TheMinerMag plots an estimation of the self-mining revenue of companies that have scheduled earnings calls in the coming weeks. The estimation is based on their monthly production and bitcoin’s average prices from July to September.

On a quarter-over-quarter basis, Stronghold and Marathon are estimated to post a 26.37% and 19.72% growth, respectively, due to their ramped-up mining capacity. Terawulf and Cipher are also projected to have a single-digit growth, by 9.74% and 7.13%. Bitfarms, however, is estimated to post a decrease of 7.43% due to its declined bitcoin production over the quarter.

Earnings call schedule:

Bitfarms: Nov. 7

Cipher: Nov. 8

Marathon: Nov. 8

Terawulf: Nov. 13

Stronghold: Nov. 14

Regulation News

Province banning N.B. Power from selling electricity to crypto mines - CBC.ca

Plans for DeWitt Bitcoin Mine Taking Shape Amidst Foreign Ownership Concerns - Arkansas Business

Hardware and Infrastructure News

Bitcoin Miner Marathon Tests BTC Mining With Methane Gas From Waste Landfill - CoinDesk

Corporate News

Northern Data Signs $600 Million Debt Facility with Tether - TheMinerMag

Shareholders Vote Scheduled for GRIID’s SPAC Merger Deal - TheMinerMag

Core Scientific Eyes Chapter 11 Exit by Year End - TheMinerMag

Financial News

Quality Bitcoin Mining Stocks Offer a Good Way to Gain Exposure to the Next Bull Run: Bernstein - CoinDesk

Feature

Iris Energy’s AI Play W/ Dan Roberts - The Mining Pod

Why a Bitcoin ETF Is Making BTC Miners Nervous? - Decrypt

In Texas, Bitcoin Springs from Gas Wells - The Wall Street Journal - link