For what it is worth, Marathon Digital successfully adhered to its 100% hodl strategy despite the market turbulence in 2022, closing the year with 12,232 BTC on its balance sheet.

And, it even reduced the Silvergate revolving credit to zero in December while having increased unrestricted cash to over $100 million — a sign that additional liquidity may have rolled in through the equity market.

For the first nine months of 2022, Mara raised $200 million from issuing stocks and $50 million from a term loan with Silvergate. It closed Q3’22 with $55 million unrestricted cash in hand after incurring ~$20 million in cash expenses in the quarter to cover recurring costs related to mining, payroll and financial interest.

Stepping into Q4, Mara took on more debts by borrowing $50 million in revolving credits from Silvergate only to face a riskier situation around early to mid-November when bitcoin dropped below $16k. Its bitcoin reserves that were secured against the debts could have been at risk had the market failed to hold above $12k.

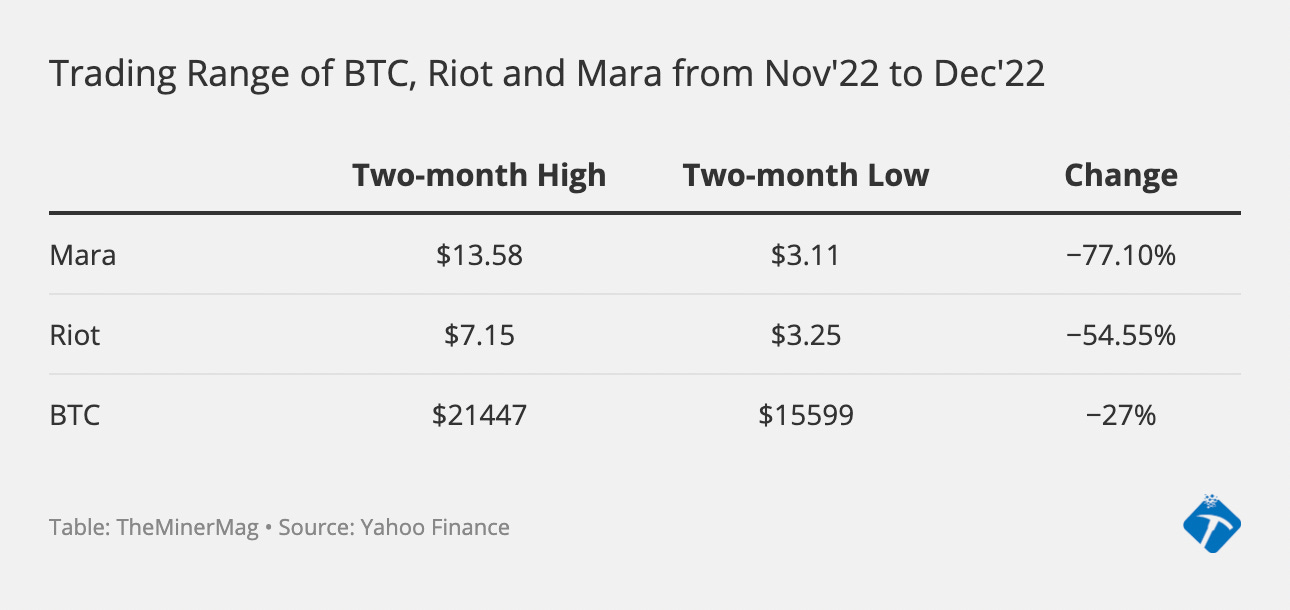

Mara reduced its revolving credit to $30 million later in November and paid it off entirely in December, likely with a new capital injection of a similar size from share dilution. Its stock price’s two-month low between November and December was down 77% from its high over the same period, much more volatile than that of Riot and BTC.

Still, 36% of Mara’s bitcoin holdings — or 4,417 BTC — were restricted as of Dec. 31, being secured against its remaining loans. Its term loan agreement requires an LTV ratio of 65%. If Mara doesn’t borrow additional debts this year, it has enough bitcoin to meet margin calls unless bitcoin tanks to below $5k.

Regulation news

Greenidge to meet New York State DEC requirement next week - Spectrum News

Financial news

Marathon closes 2022 with $103.7 million cash after paying down debt - The Block

Stronghold Continues Debt Restructuring With Convertible Preferred Share Issuance - CoinDesk

Corporate news

Singapore Arbitrator Rules Against Poolin’s IOU Model, But the Firm Hasn't Paid Yet - CoinDesk

Riot Drops ‘Blockchain’ From Name After Rough Year - Bloomberg

Core Scientific to Shut 37,000 Celsius Rigs - Bloomberg

Feature

Dallas company finds a way to profit off bitcoin mining without accepting the high risk - The Dallas Morning News

Are you a journalist or analyst seeking more information or comments from industry experts? We’d love to help!