13 U.S-listed mining companies have reported their Q2 earnings so far, revealing a common theme: the need for cash is not slowing down. According to calculations by TheMinerMag, this urgency is driven by the state of bitcoin’s hashprice, which is not generating a meaningful cash flow after the halving. To mitigate this, some are also turning to debt financing once again.

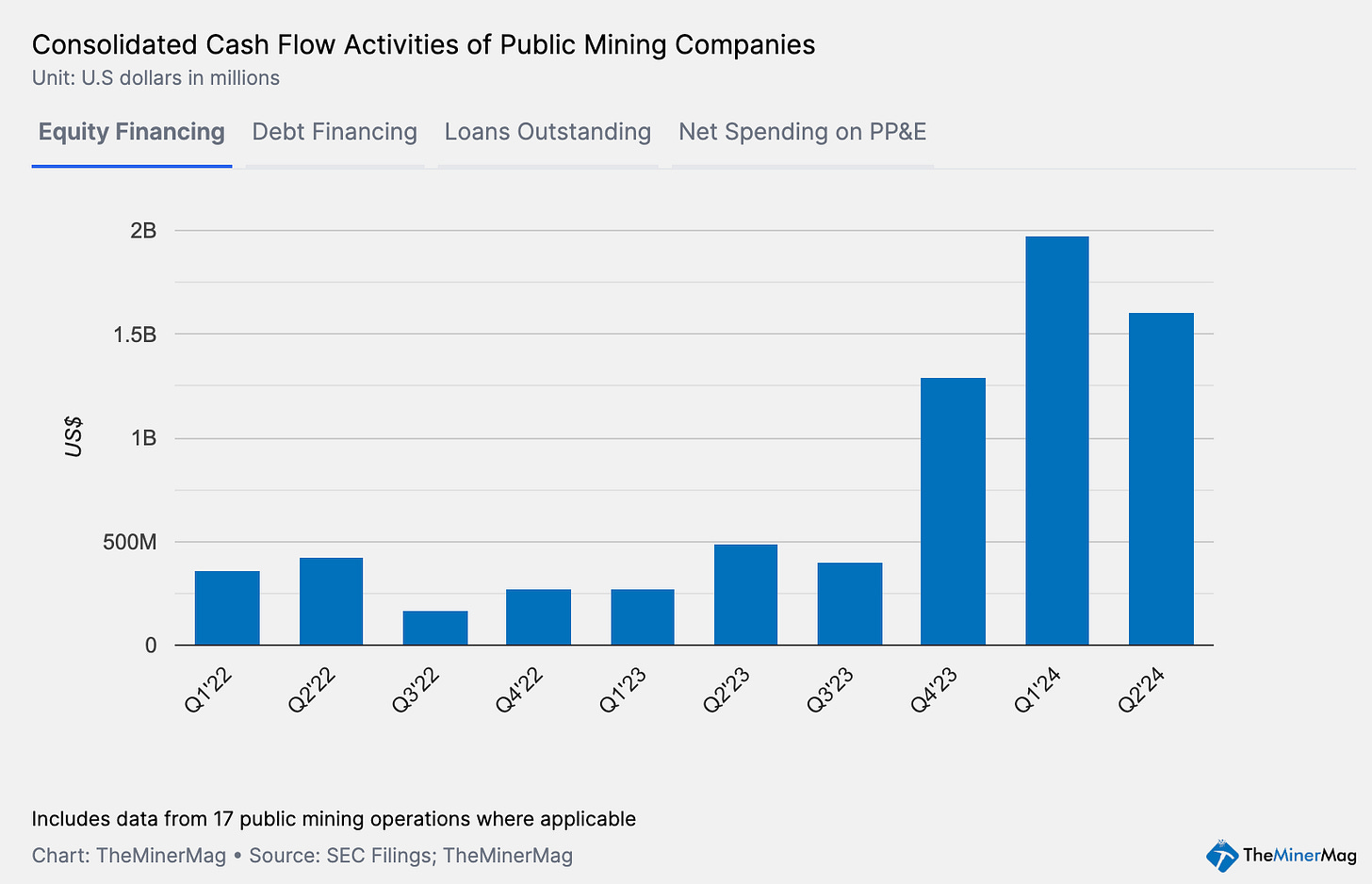

Nine out of the 13 companies – Bitdeer, Bitfarms, Cipher, CleanSpark, Core, HIVE, Marathon, Riot, and Terawulf – collectively raised $1.25 billion via various stock offering programs during Q2. Iris Energy has not yet disclosed its earnings but reportedly raised $458 million in Q2 through an at-the-market offering.

Based on this, TheMinerMag’s dashboard shows that public mining forces raised over $1.6 billion via equity financing over the first quarter since the halving and an additional $530 million in Q3 so far.

Although that number didn’t beat the record of nearly $2 billion raised in Q1 by stock offerings of mining pubcos., it is interesting to note the rise of convertible notes and asset-backed loans again since Q2.

Per TheMinerMag’s dashboard, the combined debt financing of public mining companies has been consistently negative since the beginning of the 2022 bear market amid the Luna collapse, suggesting their deleveraging efforts over the past two years.

While many companies continued to deleverage their financial positions during Q2, their combined debt financing turned positive because Hut 8, which did not raise any proceeds from stock offerings, received proceeds of $150 million via the Coatue notes.

Additionally, in the past week, we saw Marathon and Core Scientific offer convertible notes totaling $700 million. In Core’s case, the new convertibles were part of a debt restructuring effort, replacing existing debt with notes at a lower interest rate. For Marathon, the convertible notes were mostly used to acquire additional bitcoin from the market. CleanSpark disclosed in its Q2 filing that it has entered into credit facilities with Coinbase for loans collateralized by bitcoin. Canaan stated that it pledged 530 BTC during Q2 to secure term loans totaling $19.2 million for 18 months.

This is all but surprising given bitcoin’s low hashprice around $43/PH/s – and that is after a 4.2% difficulty ease adjusted today.

Regulation News

Russia Officially Legalizes Crypto Mining - TheMinerMag

Hardware and Infrastructure News

CleanSpark Orders 7.8 EH/s of S21XP Bitcoin Miners for $167M - TheMinerMag

Corporate News

Bitcoin Miner With Celsius Assets Delays IPO After Losing CEO and Auditor - CoinDesk

Bitfarms Founder Steps Down in Leadership Overhaul - TheMinerMag

Marathon Buys Bitcoin with $249M from Convertible Notes - TheMinerMag

Riot Buys Another 1 Million Bitfarms Shares, Increasing Ownership Stake to 18.9% - The Block

Financial News

Argo Repays Galaxy Debt after Equity Raise - TheMinerMag

Marathon Plans $250M Convertible Notes to Buy Bitcoin - TheMinerMag

Tampa bitcoin company gets $5.6M loan to buy Texas mining facility - Business Observer

Core Scientific Eyes $350M Notes to Repay Bitcoin Mining Debt - TheMinerMag

Feature

Hashprice, Iris Energy’s Failed Hedge and Paraguay Mining - The Mining Pod

The Road To 20 EH/s With Zach Bradford - The Mining Pod

Where bitcoin miners stand after Q2 disclosures - Blockworks