Bitcoin Miners Spend $3.6B on Machines and Infrastructure

A majority of the funds flow to miner manufacturers

All major public bitcoin mining companies have released their Q3 earnings—except CleanSpark, whose fiscal year ended in September, delaying its report. According to TheMinerMag, 16 publicly traded mining firms collectively raised over $5 billion through equity and debt financing year-to-date, while spending more than $3.6 billion on property, plant, and equipment (PP&E).

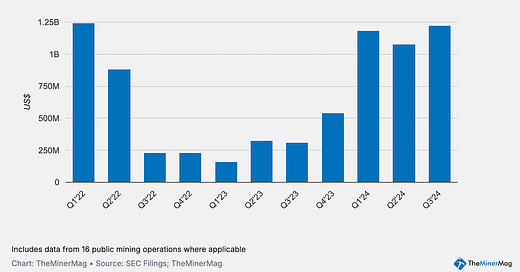

In a quarterly breakdown, the latest quarter saw the highest net PP&E spending by public mining companies since Q1 2022, which marked the onset of the last bear market. Once CleanSpark’s numbers are included, Q3’s spending could surpass Q1 2022’s record as shown in chart below (view the interactive chart here).

This sustained investment in hardware and infrastructure aligns with the surge in the bitcoin network hashrate (a measure of the global computing power dedicated to bitcoin mining), which recently hit an all-time high near 790 exahashes per second or 790 EH/s (7-day moving average) despite the bitcoin’s halving. (The mining difficulty is expected to rise again by another 2% in five days)

Mining hardware made up the lion’s share of PP&E spending. According to preorder data tracked by TheMinerMag, public miners have committed $2 billion to hardware purchases between July 2023 and March 2024 for delivery through September 2024.

Bitmain remains the dominant manufacturer of ASIC mining machines, capturing a significant portion of these purchases. However, reports indicate that some shipments of Bitmain’s Antminer machines have been held up and delayed at U.S. ports. This has fueled speculation and potential FUD (Fear, Uncertainty, and Doubt), especially amid concerns about possible ties to the recent Huawei/Sophgo issue. If connected, such developments could have major implications for an industry involving billions of dollars.

Meanwhile, equity financing by mining companies appears to be slowing down, with companies raising only $813 million in Q3 compared to $1.6 billion in Q2. However, debt financing is making a comeback. Mining companies raised $500 million in Q3, marking the largest single-quarter debt issuance since Q1 2022.

Regulation News

ERCOT Bitcoin Mines Required to Report Power Demand to Texas State - TheMinerMag

Judge blocks state from enforcing foreign ownership law against crypto mine - Arkansas Times

Hardware and Infrastructure News

Officials are halting Bitmain units at U.S. ports, industry firms report - Blockspace Media

Bitcoin Miner Cipher Acquires New 100 MW Site in West Texas - TheMinerMag

IREN Sold 4.1 EH/s S19j Pro Bitcoin Hashrate for $2/TH/s - TheMinerMag

Corporate News

BitMine Leverages Luxor’s Deliverable Forward Contract to Purchase New Machines and Hedge Hashprice - Link

TeraWulf Announces Promotion of Sean Farrell to Chief Operating Officer - Link

Financial News

Bitdeer to Raise $360M via Convertible Notes amid Bitcoin Rally - TheMinerMag

MARA Buys 5771 Bitcoin with Half of $1B Convertible Raise - TheMinerMag

Tether-Backed Northern Data Gets Offers for Crypto Mining Arm - Bloomberg

Canaan Inc. Closes $30M Series A-1 Preferred Shares Financing - Link

Feature

ASIC Prices, Russia Restrictions, Alaska Bitcoin Mining, $4.6B Mining Stock Shorts, Bye Bye Gary - The Mining Pod

Hut 8, US Bitcoin, And Synteq With Jaime Leverton - The Mining Pod

Public Miner M&A Tops $470 Million in 2024 - The Mining Pod