Very good Thursday morning to you.

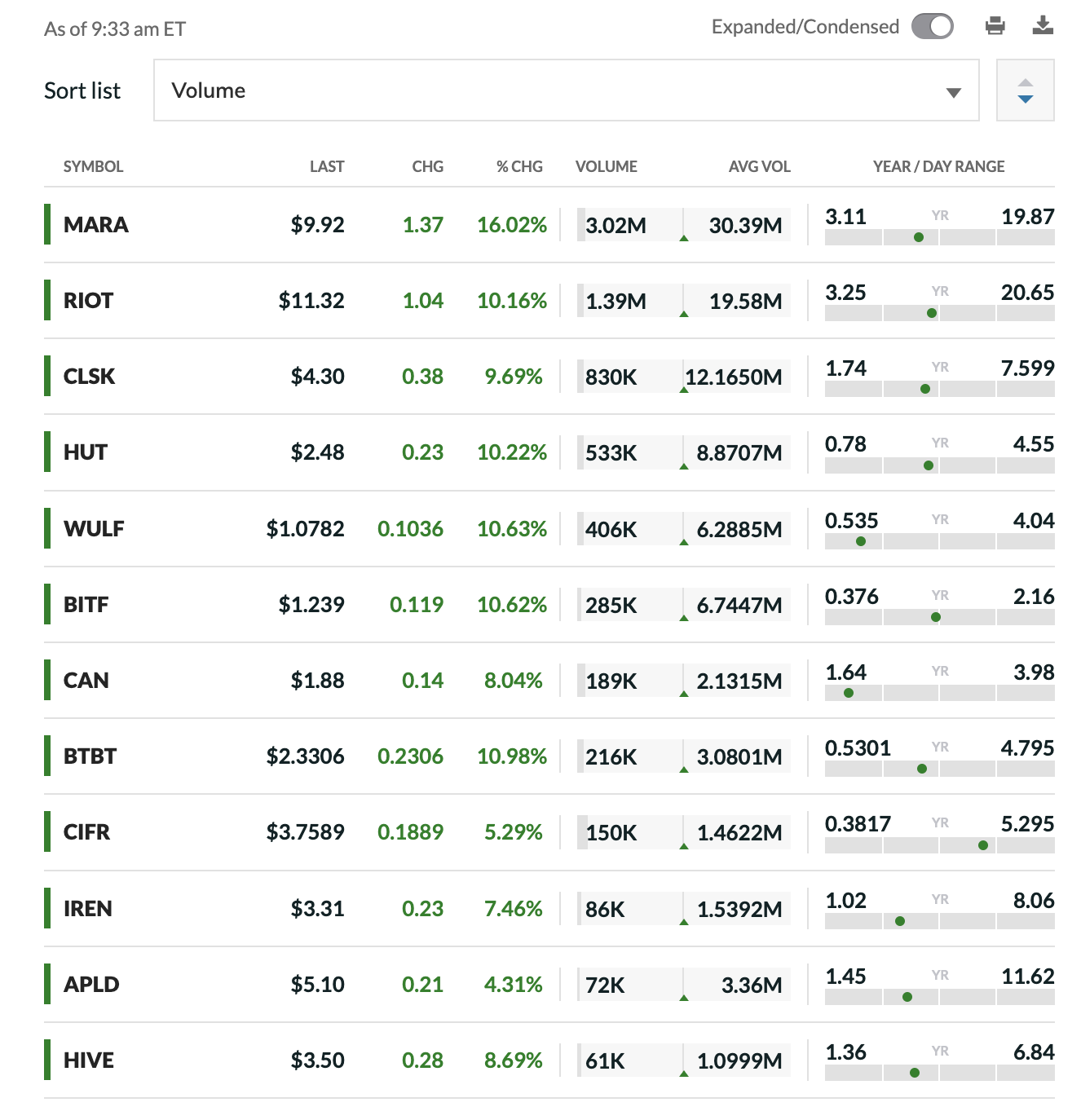

Bitcoin’s price rallied through $37,500 earlier today, reaching the highest point since early May 2022. Bitcoin’s hashprice has also climbed above $80/PH/s as the network’s hashrate remains steady at around 460 EH/s.

It has been quite a ride over the past 18 months as we witnessed the collapse of Luna, the arrest of Do Kwon, the fall of FTX, the conviction of Sam Bankman-Fried, the bankruptcy of BlockFi, Celsius, Compute North, Core Scientific, and their potential exits.

And yet we also saw several mining companies emerge much stronger through industry consolidation over the past year. Most importantly, there are a bunch of bitcoin ETF applications pending the SEC’s approval, one of which is from the world’s largest asset manager, BlackRock.

Free bitcoin

Several public mining companies have released third-quarter earnings reports this week. Notably, Riot Platforms reported a negative $6.1k cost for mining bitcoin thanks to the power curtailment credits it received in the mining hotbed of Texas.

Riot’s cost of bitcoin mining revenue totaled $24.4 million over the last quarter, the majority of which were power bills. From July to September, it mined 1,102 BTC, which would translate to a cost of production of $22,177 per BTC.

But Riot participated in Texas’ demand response and ancillary service program and turned off a large portion of its proprietary hashrate to help strengthen the grid. In return, it received nearly $50 million in power curtailment credits that can be allocated to offset the power bills in its bitcoin mining and hosting segments proportionally.

Because the amount of credits allocated to the bitcoin mining segment was $31.2 million, the cost of bitcoin mining revenue was hence reduced to -$6.8 million on its book.

But to be sure, the negative cost of production does not seem to suggest Riot received additional cash benefits on top of the bitcoin mined. Rather, it was more like Riot effectively mined the bitcoin for free and still had remaining credits. It is unclear, though, how the remaining credits could be extended to the next quarter — if at all. If the credit excess has a rather imminent expiration date and can’t be fully utilized, doesn’t that mean Riot may have curtailed too much?

Riot’s trade-off was obviously not being able to mine more bitcoin during the summer months and hence losing the production share to its competitors as well as the upside potential of hodling those sats.

Regulation News

Argentina Presidential Hopeful Wants to Mine Bitcoin From 'Dead Cow' - Decrypt

Hardware and Infrastructure News

Cipher to Acquire New Site for $7 Million; Buys 1.2 EH/s of S21 - TheMinerMag

Hut 8 to Bid for 310 MW Power Facilities in Canada - TheMinerMag

Corporate News

Bitcoin Miner Marathon Touts Renewable Expansion in Paraguay - TheMinerMag

Core Scientific Posts 11% Decline in Q3 Revenue Amid Market Share Erosion - TheMinerMag

Roger Ver Suing Matrixport over $8 million in Frozen Crypto - The Block

Luxor Refutes Claims its Bitcoin Hashrate-backed Product is BlockFi, Celsius 2.0 - Cointelegraph

Financial News

Public Bitcoin Miners Net $164M in ‘Uptober’ Sales - TheMinerMag

Ordinals price surges 48% following Binance listing announcement - The Block

GRIID to Extend Tennessee Bitcoin Mining Site to March 2026 - TheMinerMag

Riot Raises $230 Million in Equity to Scale Bitcoin Mining - TheMinerMag

Bitfarms Doubles Down on Equity Raise with $31 Million in Q3 - TheMinerMag

Feature

Biden’s AI Executive Order, Core Scientifics Exiting Chapter 11 and Tether’s $600M Loan - The Mining Pod

Why Tether Is Mining Bitcoin W/ Paolo Ardoino - The Mining Pod