Riot’s $31 million energy credit last month made headlines over the past week. Most media outlets focused solely on the huge sum but few noted that this is a unique situation during the bear market.

Bitcoin’s hashprice has dropped to a level so low that mining companies may be better off utilizing parts of their proprietary hashrate to do something else than mining for a better gross margin, especially in a season when such options become more lucrative.

Riot mined an actual 330 BTC in August while receiving $24.2 million in power credits and $7.4 million in demand response credits. Based on bitcoin’s average prices and how it allocated energy credits for the proprietary mining segment in Q2, Riot was estimated to have self-mined 1,056 BTC and BTC equivalent.

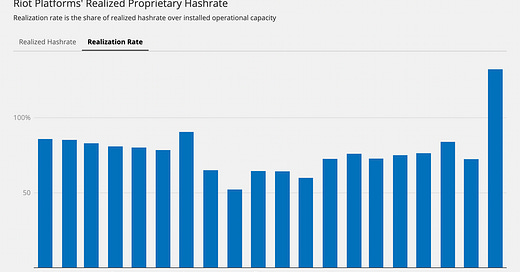

According to TheMinerMag’s analysis, that translates to a realized hashrate of 14.16 EH/s, which is 132% of Riot’s installed hashrate capacity of 10.7 EH/s. Riot had similar energy programs in 2022 but never realized more than 100% of its installed hashrate since bitcoin’s hashprice in the summer of 2022 was mainly around $90 to $110/PH/s; over the past three months, it topped at $80/PH/s and now hovers above $60/PH/s.

Essentially, if Riot switched on all of the 10.7 EH/s last month in Texas, it would not be able to mine 1,056 BTC anyway at the current network hashrate levels. The trade-off, though, is that Riot gave up the chance to stack more bitcoin for the long-term upside. After all, a liquid market for buying bitcoin with energy credits does not seem to exist yet.

For what it’s worth, the existence of such power strategy and energy programs in Texas has helped strengthen the state’s position as a mining hub. TheMinerMag has updated its North America power capacity distribution map based on data from 20 public mining companies as of June 2023, which added up to 4.76 GW in total self-mining and hosting capacity.

That accounts for about 34.7% of the network’s total capacity as estimated by the recently revised Cambridge Bitcoin Electricity Consumption Index and more than 2.2 GW of that is in the Lone Star state. See the map here.

Regulation News

Hochul, DEC Urged to Deny Air Permit for NT Crypto Mine - Niagara Gazette

Hardware and Infrastructure News

Canaan Touts A14 Efficiency to be Sub-20J/TH Ahead of Sep. 12 Launch - Link

Bitcoin's 30-day Hashrate High Hits Miner Profitability - Blockworks

MicroBT Starts Autumn Sales Amid Bitmain and Canaan Product Launch - Link

Bitdeer Energizes 3.3 EH/s in Gedu, Bhutan - Link

F2Pool Puts on Hold 20 BTC in Likely Mistaken Fees for Three Days Before Distribution - Link

Corporate News

Riot Responds to Recent Inquiries Regarding Its Power Strategy - Link

Marathon Shares Drop 8% After Senior Note Exchange - MarketWatch

Finance News

Coinbase Creates New Crypto Lending Service Geared Toward Large Investors - CoinDesk

Feature

Bitcoin Miners Take Fresh Look at Hedging Products - Axios

A Deeper Look at Hut 8’s Imminent Merge with USBTC - Blocksworks

Are you a journalist or analyst seeking more information or comments from industry experts? We’d love to help!