There have been several machine purchase announcements over the past week as mining companies compete for fleet efficiency and production capacity ahead of the halving, which is now less than 20,000 blocks, or roughly 138 days, away.

It seems like the upcoming halving and this year’s market rebound from the 2022 bottom has bolstered mining companies’ capital expenditure.

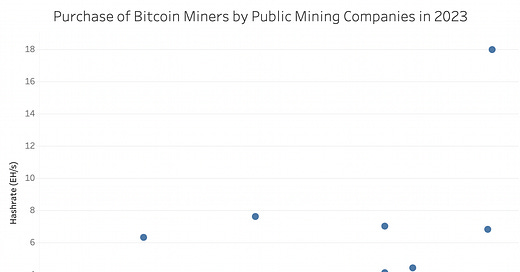

According to data compiled by TheMinerMag, a dozen public mining companies have made purchase orders for spot and future stocks of bitcoin mining machines totaling over 70 EH/s this year so far. Their machine purchase commitments total more than $1.2 billion year-to-date, with approximately $750 million signed over the past two months.

Some of those purchases have already been paid for and some will be due in monthly batches over the next year and beyond. In total, public mining companies tracked by TheMinerMag have already spent $747 million in the first three quarters this year on property, plant and equipment.

The chart below plots different purchases signed this year by public mining companies. For a fully dynamic chart with details of the buyers, the corresponding hashrate model, and the investment amount, please visit this article published on TheMinerMag's website.

Chinese miner manufacturers are set to be the biggest winners from these purchase deals. Of the $1.2 billion investment identified by TheMinerMag, MicroBT and Bitmain account for 56% and 42%, respectively, with Canaan accounting for the rest of it.

It is interesting to see that the contracts from public mining firms for Antminers were more granular than those for WhatsMiners. Although there have only been four known bulk purchases of WhatsMiners from Riot, Northern Data, and Bitfarms, the preordered hashrate already totals nearly 40 EH/s. And just on Thursday, UAE-based Phoenix Group said it signed a contract to procure $136 million worth of WhatsMiners without specifying the hashrate or model.

Also notable this year is the participation of miner manufacturers in self-mining activities. For instance, Canaan has been hosting Avalon miners in Stronghold’s facility in a profit-sharing mode since May. Several public mining firms have bought 12 EH/s of S19XPs and yet Bitmain has shipped nearly 40 EH/s of S19XPs to its subsidiary in Georgia. The influx of S19XPs also coincides with the surge in hashrate of Bitmain-tied Antpool.

Regulation News

Bitcoin Miner Wins a Round In DeWitt, but Fight Goes On - Arkansas Business

Minnesota ‘Degen’ Accused of Stealing Power for Bitcoin Mining – TheMinerMag

Hardware and Infrastructure News

Bitmain-Tied Antpool Overtakes Foundry USA in Bitcoin Blocks Mined - TheMinerMag

Bitcoin Miners Commit $620 Million in Equipment Preorders - TheMinerMag

Riot Buys 18 EH/s of M66S Bitcoin Miners for $290 Million - TheMinerMag

MaraPool Mines 4.2% of Bitcoin Rewards with 23.7 EH/s Energized - TheMinerMag

Texas Bitcoin Mining Operation Shutdown By Host’s Armed Security - Bitcoin Magazine

Bitcoin Dev Luke Dashjr Calls Inscriptions 'Spam,' Community Members Push Back - The Block

Bitcoin Miner Phoenix Buys WhatsMiners in $136 Million Contract - TheMinerMag

Corporate News

Iris Energy Co-Founders Sell $10 Million in Bitcoin Miner Shares - TheMinerMag

Celsius Network Faces Roadblocks in Pivot to Bitcoin Mining - Reuters

Financial News

CleanSpark Leads Bitcoin Mining Stocks in Setting Yearly Highs - TheMinerMag

Crypto Firm Phoenix Hits $3.3 Billion Value in Abu Dhabi Debut - Bloomberg

Feature

Bitcoin Mining Used More Water Than New York City Last Year - WSJ

The US Bitcoin & Hut 8 Merger W/ Asher Genoot & Sue Ennis - The Mining Pod