These Pools Are Consolidating Bitcoin Block Rewards with Antpool

How many of them are diverting hashrate as well?

One of the most notable developments in bitcoin mining in 2023 was the resurgence of hashrate connected to Antpool, which surpassed Foundry USA in November in the number of blocks mined.

Although it appears that Foundry regained the upper hand, on-chain transactions imply that the hashrate diverted to Bitmain-tied Antpool could be larger than expected.

According to TheMinerMag, 10 of the top 15 mining pools have consolidated coinbase block rewards since last year. Many of them were launched as independent operators with no notable financial backers.

Since early 2022, the coinbase payout addresses of Antpool, Binance Pool, Ultimus Pool, BTC.com, 1THash, Poolin, EMCD Pool, Luxor (changed after Dec. 7), SECPool, and Braiins Pool have regularly sent at least a portion – if not the entirety – of their block rewards to the same output addresses in single transactions.

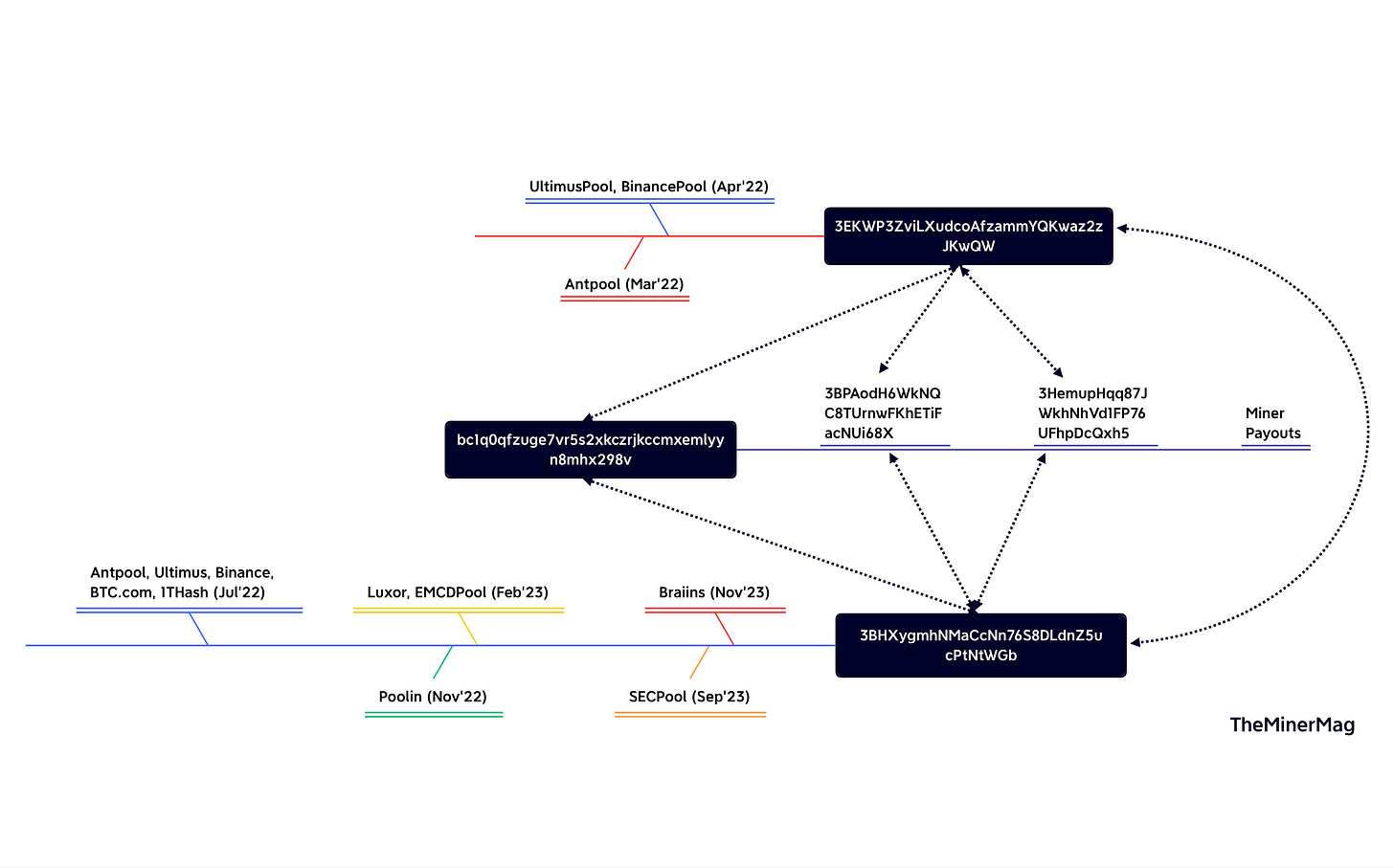

For instance, Antpool, Binance Pool, Braiins Pool, and Poolin recently sent about 100 BTC in a transaction to two output addresses. Other recent transactions exhibited similar behaviors by other pools, and this pattern could be traced back to April 2022, as mapped out in the diagram below by TheMinerMag.

In March 2022, Antpool was the only pool sending block rewards to the 3EKWP address shown above. BinancePool and Ultimus Pool started to route their coinbase payouts to the same address in April in single transactions with Antpool.

After July 2022, Antpool, Ultimus Pool, Binance Pool, BTC.com and 1THash began consolidating their block rewards to the 38HXyg address. They were soon joined by Poolin, and much later, Luxor and EMCDPool, followed by a new pool called SECPool, and most recently Braiins (previously known as Slushpool).

These pools have also sent block rewards in single transactions to the bc1q0q address, which has been interacting with the 38HXyg and 3EKWP addresses since 2020. After consolidation, these three addresses sent bitcoin to the 3BPAodH6 and then 3Hemup addresses before what seemed to be final payout distributions.

This consolidation pattern appears to result from certain payout processing agreements between these pools and an entity financing their daily payouts.

All the pools mentioned above adopt the Full Pay-per-Share (FPPS) model so they have daily liabilities to miner customers regardless of their luck in producing blocks. Hence, having strong financial backing becomes increasingly necessary to hedge against bad luck. Notably, Braiins Pool announced in November that it would switch to FPPS. As the longest-running bitcoin mining pool, Braiins used to pay miners based on actual blocks mined.

Given that those block rewards were sent in single transactions to the same outputs, the financing entity likely controls all the coinbase payout and hopping addresses.

It is unclear who this supposedly financing counterparty is. Still, it is reasonable to believe it is Antpool or Bitmain-tied entities, given Antpool’s transactional pattern as early as March 2022. That would raise a question of whether or how many of these pools have also diverted hashrate to Antpool as part of the financing agreements.

For context, Antpool has mined 26.6% of the blocks in December thus far while Binance Pool, the second largest pool within the group, mined 6%. The remaining parties in the group account for another 6% this month. It’s worth noting that Binance used to be partially a hashrate proxy of BTC.com when it started in 2020 before BTC.com was sold by Bitmain in 2021.

Regulation News

Massena extends moratorium on crypto mining until April 2024 - North Country Now

Bitcoin faces risk of protocol-level censorship as miners under increasing regulatory pressure - The Block

Hardware and Infrastructure News

Stronghold Curtailed Hashrate at Pennsylvania Bitcoin Mining Site - TheMinerMag

Bitcoin Mining Difficulty Sets ATH as Hashrate Tops 525 EH/s - TheMinerMag

HIVE Joins Bitcoin Mining Arms Race, Buying 1.4 EH/s of S21 - TheMinerMag

Financial News

Akron Energy Raises $110M to Grow U.S. Bitcoin Mining Capacity – TechCrunch

Marathon Digital Leads Crypto Stock Surge on Bitcoin ETF Hopes - Bloomberg

Bitcoin miners splash out $600mn in race to squeeze out rivals - Financial Times

Feature

OG Bitcoin Mining Stories W/ Philip Salter (Genesis Digital Assets) - The Mining Pod

This N.Y.U. Student Owns a $6 Million Crypto Mine. His Secret Is Out - NYT

Bitcoin Mining In 2023 W/ Park Merritt (Coin Metrics) - The Mining Pod